Financial Analyst Resume: Examples, Skills & Template

Know your worth. Never say a number first.

That's my advice for salary negotiations, but it also applies to your resume. Your financial analyst resume needs to demonstrate your worth before you ever get to the negotiation table.

I've placed hundreds of financial analysts at Fortune 500 companies and investment firms. The resumes that land interviews have one thing in common: they quantify business impact with precision. "Performed financial analysis" doesn't cut it. "Identified $3.2M in cost savings through variance analysis, improving EBITDA margin by 4.2%" gets you the interview.

This guide will show you exactly how to build a financial analyst resume that demonstrates analytical rigor, technical expertise, and measurable business impact.

What Makes a Financial Analyst Resume Stand Out

For comprehensive strategies on optimizing your resume language, our professional impact dictionary covers the exact verbs and metrics for finance roles.

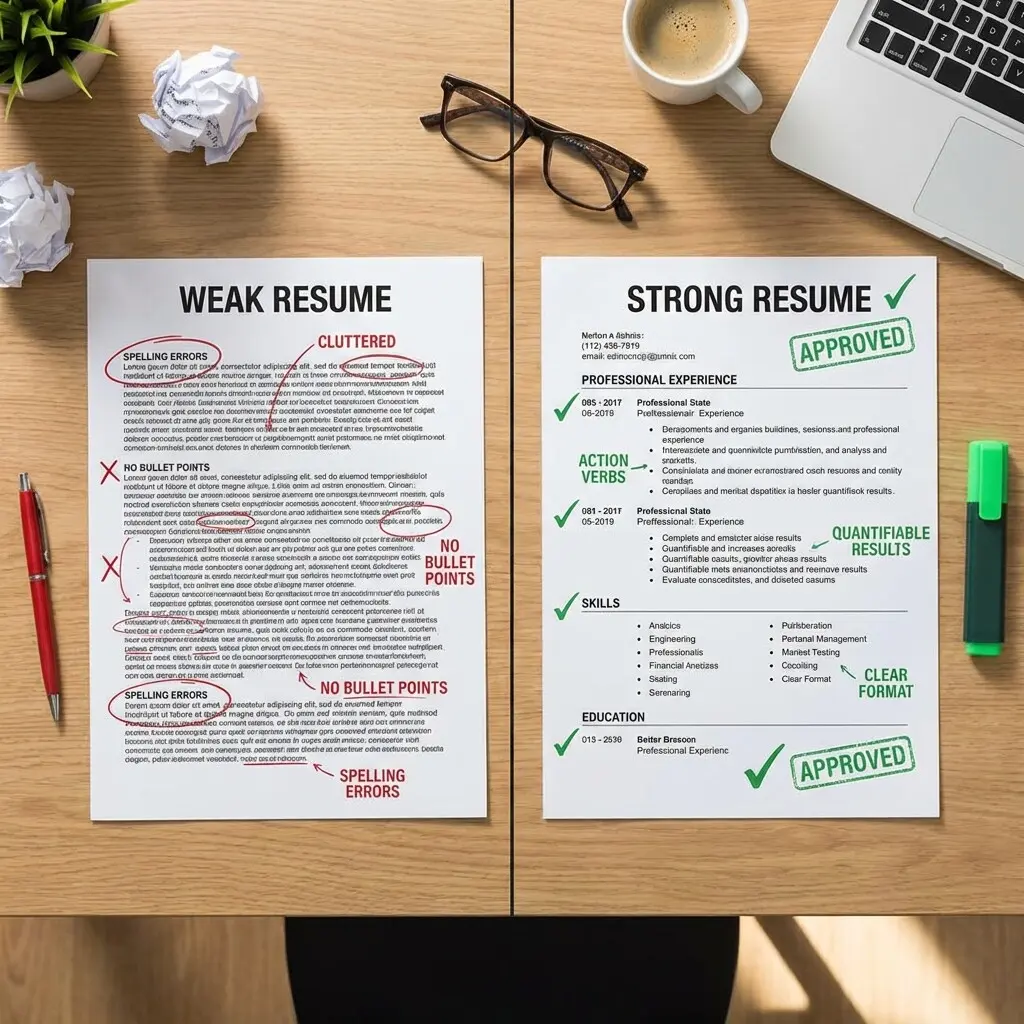

Financial analyst resumes are evaluated by people who analyze data for a living. They'll spot vague claims, inconsistent formatting, or missing metrics immediately.

Here's what separates strong financial analyst resumes from weak ones:

The biggest mistake? Describing what you analyzed instead of the impact of your analysis. "Analyzed monthly financial statements" tells me nothing. "Identified $1.8M revenue leakage through monthly variance analysis, leading to process changes that recovered 85% of lost revenue" shows analytical skill and business value.

Essential Skills for Financial Analyst Resumes

Financial analysts need a combination of technical proficiency, analytical capabilities, and business acumen.

Technical Skills

These are the hard skills that ATS systems scan for and hiring managers expect:

Analytical Competencies

These demonstrate your ability to generate insights:

Business and Communication Skills

Critical for translating analysis into action:

For more on structuring your skills section, see our ultimate resume guide.

How to Structure Your Financial Analyst Resume

Professional Summary: Lead with Impact

Your professional summary should immediately establish your credibility and value proposition.

Strong Example:

"Financial Analyst with 6+ years of experience in FP&A and corporate finance for technology companies ($100M-$500M revenue). Expert in financial modeling, forecasting, and variance analysis. Identified $8M in cost savings and revenue opportunities through data-driven analysis. CFA Level II Candidate with advanced Excel, SQL, and Tableau expertise."

Weak Example:

"Experienced financial analyst seeking a challenging position where I can utilize my analytical skills and contribute to company success."

The strong example quantifies experience, specifies expertise, demonstrates impact, and highlights credentials.

Work Experience: Show Business Impact

For each role, focus on the business outcomes of your analysis. Use this formula:

Analysis Type + Business Context + Quantifiable Impact

Each bullet demonstrates analytical skill, business context, and measurable impact.

Technical Skills: Be Specific

Don't just list "Excel" or "Financial Modeling." Be specific about your capabilities:

Financial Modeling & Analysis

- 3-Statement Modeling (Income Statement, Balance Sheet, Cash Flow)

- DCF Valuation and Comparable Company Analysis

- LBO Modeling and M&A Analysis

- Scenario Planning and Sensitivity Analysis

- Budget vs. Actual Variance Analysis

Technical Tools & Software

- Excel: Advanced formulas, pivot tables, VBA macros, Power Query

- SQL: Data extraction, joins, aggregations, query optimization

- Tableau / Power BI: Dashboard creation, data visualization

- Bloomberg Terminal, Capital IQ, FactSet

- ERP: SAP FI/CO, Oracle Financials, NetSuite

Statistical & Programming

- Python (pandas, NumPy) or R for financial analysis

- Regression analysis and forecasting models

- Monte Carlo simulation

Financial Analyst Resume Template

Here's a proven structure for financial analyst resumes:

Header

Michael Chen, CFA Level II Candidate

New York, NY | (555) 987-6543 | michael.chen@email.com | linkedin.com/in/michaelchen

Professional Summary

Financial Analyst with 5+ years of experience in FP&A and investment analysis for technology and healthcare companies ($50M-$500M revenue). Expert in financial modeling, forecasting, and data-driven business insights. Identified $6M in cost savings and revenue opportunities through variance analysis and strategic recommendations. CFA Level II Candidate with advanced Excel, SQL, Tableau, and Bloomberg Terminal expertise.

Work Experience

Senior Financial Analyst

TechGrowth Inc., New York, NY

January 2022 - Present

Financial Analyst

HealthCare Solutions Corp., Boston, MA

June 2019 - December 2021

Education

Bachelor of Science in Finance

Boston University, Boston, MA

Graduated: May 2019 | GPA: 3.8/4.0

Relevant Coursework: Corporate Finance, Financial Modeling, Investment Analysis, Financial Statement Analysis

Certifications

- CFA Level II Candidate (June 2026 exam scheduled)

- CFA Level I Passed (June 2024)

- Bloomberg Market Concepts (BMC) Certified

Technical Skills

Financial Modeling: 3-Statement Models, DCF Valuation, LBO Models, M&A Analysis, Scenario Planning

Excel: Advanced formulas, pivot tables, VBA macros, Power Query, data analysis

Data & Analytics: SQL, Tableau, Power BI, statistical analysis, forecasting

Financial Software: Bloomberg Terminal, Capital IQ, FactSet

ERP Systems: SAP FI/CO, Oracle Financials

Key Competencies by Analyst Level

Entry-Level Financial Analysts (0-2 years)

Focus on technical proficiency and foundational skills:

Mid-Level Financial Analysts (2-5 years)

Emphasize independent analysis and business partnership:

Senior Financial Analysts (5+ years)

Highlight strategic impact and leadership:

Common Mistakes on Financial Analyst Resumes

After placing hundreds of financial analysts, here are the mistakes that cost candidates interviews:

1. Vague Metrics

"Improved forecasting accuracy" means nothing. "Improved forecasting accuracy from 78% to 93%, reducing budget variance by $800K annually" demonstrates precision and impact. Also avoid words that weaken your resume.

2. Missing CFA Candidacy

If you're pursuing your CFA, list it prominently. "CFA Level I Candidate" or "CFA Level II Passed" shows commitment and is highly valued. For proper formatting, see how to list certifications.

3. Generic Technical Skills

Don't just list "Excel." Specify "Advanced Excel: VBA macros, pivot tables, INDEX-MATCH, Power Query, financial modeling." Specificity demonstrates expertise.

4. No Business Context

Every analysis should connect to a business outcome. Don't just describe what you analyzed—explain why it mattered and what changed as a result.

5. Ignoring Industry Specifics

Financial analysis varies by industry. FP&A for SaaS companies focuses on MRR, churn, and CAC. Investment banking emphasizes M&A modeling and valuation. Tailor your resume to the industry.

How to Tailor Your Financial Analyst Resume

Step 1: Identify the Role Type

Is this FP&A, investment banking, equity research, corporate finance, or commercial finance? Each requires different emphasis.

Step 2: Match Technical Requirements

If they mention Bloomberg Terminal, make sure it's in your skills section. If they want SQL experience, highlight your data analysis projects.

Step 3: Reorder Your Bullets

Put your most relevant achievements first. If they emphasize forecasting, lead with your forecasting wins.

Step 4: Use Their Language

If they say "variance analysis," use "variance analysis" instead of "budget analysis." ATS systems look for exact keyword matches. Also consider whether a chronological or functional format works best for your situation.

Step 5: Customize Your Summary

Adjust your professional summary to address their specific needs, industry, and company size.

Certifications That Boost Your Resume

Professional certifications demonstrate expertise and commitment:

List certifications prominently, including candidacy status for CFA or other in-progress credentials.

Frequently Asked Questions

How do I show impact if I'm an entry-level analyst?

Focus on the scope of your work: size of budgets you supported, number of reports you prepared, accuracy improvements you achieved, or time saved through automation. Even supporting roles have measurable impact.

Should I include my GPA?

Include it if it's above 3.5 and you're within 5 years of graduation. After that, your work experience speaks louder than your GPA.

What if I don't have CFA or CPA?

Emphasize your technical skills, quantifiable achievements, and relevant experience. Consider pursuing CFA Level I to demonstrate commitment, or highlight other certifications like Bloomberg Market Concepts.

How do I transition from accounting to financial analysis?

Highlight analytical work you've done: variance analysis, forecasting support, financial reporting insights, or process improvements. Emphasize Excel skills, data analysis, and business partnership.

Should I include non-finance work experience?

Only if it demonstrates transferable skills like data analysis, project management, or quantitative problem-solving. Keep the focus on finance-relevant experience.

How technical should my resume be?

Match the role. Investment banking and equity research require deep technical detail. FP&A roles balance technical skills with business partnership. Read the job description carefully.

Next Steps: Build Your Financial Analyst Resume

You now have the framework for a financial analyst resume that demonstrates analytical rigor and business impact. Here's your action plan:

- Write a results-focused summary: Highlight experience, specialization, and top achievement

- Structure work experience with metrics: Use the analysis + context + impact formula

- Detail your technical skills: Be specific about modeling, Excel, SQL, and software

- List certifications prominently: Include CFA candidacy, CPA, or other credentials

- Tailor for each application: Match keywords, reorder bullets, customize summary

- Optimize for ATS: Standard headings, exact keyword matches, clean formatting

- Proofread with precision: As a financial analyst, accuracy is non-negotiable

Build Your ATS-Optimized Financial Analyst Resume Today

Your resume is your first financial model—it needs to demonstrate precision, analytical rigor, and measurable value. Make every word count.

Related Guides

Looking for more specialized resume advice? Check out these related guides:

- Data Analyst Resume Guide — For finance roles with data focus

- Business Analyst Resume Guide — For strategy-focused analyst roles

- Accountant Resume Guide — For accounting-focused positions

- Finance Industry Resume Guide — For broader finance roles